We talk a lot about sabbaticals, but many of our clients aren’t actively taking (or even planning for) a sabbatical. We focus on overall financial and retirement planning for a lot of our clients, even if it’s not on their bucket list to quit their job and go travel for a year.

But even though not all of our clients want to take a full sabbatical, some of them are interested in experimenting with something similar: practicing retirement.

In a previous blog, we mentioned the book The 4-Hour Workweek. In this book, Tim Ferriss discusses the idea of taking mini-retirements at various points in life. What are mini-retirements? How can you take one? And why would you? Let’s find out!

Much like a sabbatical, mini-retirements can leave us feeling more fulfilled, at peace, and also more productive!

What’s the difference between a sabbatical and a mini-retirement?

In a nutshell, they are very similar! So before you get confused, know that both are possible.

We like to define a sabbatical as adventurous, nomadic, and travel-based, but some people use the time to focus on a specific project, or on building a specific skill set. Sabbaticals tend to be longer – from 6 months to 3 years – and some people still work during a sabbatical.

A mini-retirement is more of a break from work, focused on your wellbeing, slowing down, and thinking about what you really want (some of the same benefits of a sabbatical!). Mini-retirements can be a few weeks or months, and can be something you do regularly throughout your career. Or, some of our clients like to take a few mini-retirements leading up to their official retirement date to test out different retirement scenarios!

Why is a mini-retirement worth looking into?

Why wait until your career is over to really enjoy your life?

A mini-retirement can give you a much-needed reset. If you’re feeling burnt out, uninspired, or like you’re stuck on the career ladder with a lack of direction, then taking a break could be a positive life choice to consider.

Even if you’re content with your current lifestyle, when was the last time you took inventory of all the habits, decisions, and things you’ve accumulated?

A number one regret people have at the end of their life is that they wish they’d had the courage to live a life true to themselves, not the life others expected of them.

Often, when we just continue on the same path for decades, doing the next logical thing (buying a house, working towards a promotion, hanging out with the same small circle of friends), we forget to pause and think about what we really want.

A mini-retirement gives you the opportunity to ask yourself the following questions without the day-to-day construct of work influencing your responses:

- Where do you want to live? Stay where you are? A new part of town near you? A different town in your region? A totally new country, city, neighborhood, culture?

- How do you spend your time once it’s all yours? Are you getting to do some of that in your current life?

- What experiences are important for you to have? How often?

- What kind of work fills you up, challenges you, and is inspiring? Is there a way to do more of that?

- What feelings or emotions do you want to cultivate more of? Anything you could do with less of?

Your answers to these questions can help you make small tweaks to your current situation that can be very meaningful for you. Or they can set you on a path of complete change. It’s up to you!

So, instead of taking one big break many years in the future, consider taking little breaks throughout your career. Not only can this reaffirm (or challenge) your current lifestyle and boost your energy in the workplace, but can give you a new level of fulfillment and joy in life.

And to highlight a key reason to consider mini-retirement breaks, Tim Ferris, author of The 4-Hour Workweek shares his take:

“There are a few assumptions I operate on. The first is that long life is not guaranteed. If we define risk as the potential for an irreversible negative outcome, there’s more risk in postponing the things that you would most like to do for 30 or 40 years versus taking a perhaps sub-optimal, less-compounded return on investment because you allocate some of that to these mini-retirements”.

In other words, he’s willing to take on the potential financial impact of not working consistently until retirement so he can enjoy retirement-like experiences now.

We couldn’t agree more! We truly believe in balancing long term planning and savings with creating your dream life in the present.

“First of all, it’s important to recognize the tendency in every human to create false dichotomies, meaning they say, “You can have either A or B,” and not recognizing that there are often many options between those two and elsewhere. There’s usually a C option”. – Tim Ferriss

Here at Middleton & Company, we help you find your option C! And it can look different for each person!

When is a good time to take a mini-retirement?

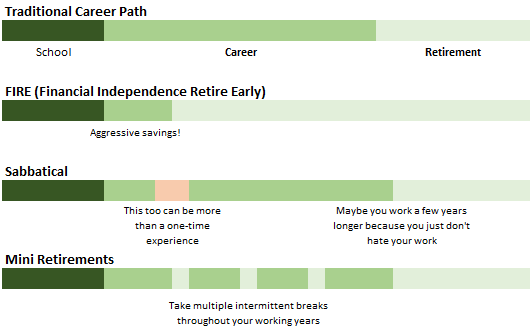

Instead of viewing working years and retirement as two separate things, why not merge them together and add in mini-retirements throughout your career? This is what many people are beginning to do, whether for their wellbeing or if they need time to reconsider their career path.

Here are some alternative options to the traditional view on career path:

There is no ‘best’ time to take a mini-retirement, but we recommend giving yourself ample time to plan and prepare. Having an idea of what version of the career path you’re working towards can be helpful in planning for the longer term.

We focus our work on sabbaticals since that’s what we personally chose to do. But mini-retirements are very similar! What they both have in common is taking time to focus on what matters to you, with the benefits of improving clarity and avoiding burnout and exhaustion.

Here are some of the most common reasons people take mini-retirement breaks:

- For health and wellbeing reasons

- To reconsider their career pathway or take advantage of time between jobs

- To take time to enjoy life outside of the typical vacation timeframe

- To redirect their focus on a volunteer opportunity they’re passionate about

- To learn a new skill or spend time on a project that’s been on their list – if they could only focus for a month, they could make real progress!

- To spend more quality time with family

So to answer the question of when to take a mini-sabbatical, it’s when one of these things becomes more important than the day-in-day-out-working-on-climbing-the-career-ladder life that many of us find ourselves in.

And when it comes to your wellbeing, don’t wait for burnout and exhaustion to hit. Ensure you are aware of your future and plan proactively for it!

What if the new word for our generation wasn’t burnout but sabbatical? Learn more here.

How to take a mini-retirement break

It may feel like a fantasy, to take time off work, or even quit your job. But we want to let you know that it can be possible! With the right planning and clarity on the types of experience you want to have, planning your perfect break could be less of a fantasy and more of a reality. If you’re unsure of how to go about this financially, this is where we come in.

A big assumption about breaks such as sabbaticals and mini-retirements is that you spend all of your money on them, and you end up not saving anything.

Taking a mini-retirement may not be as expensive as you might think.

The Tropical MBA podcast has made the point that if you’re unhappy, you can end up spending money to try to make yourself happy. Does eating out, buying gear for a hundred different hobbies, and making sure you have tickets to something fun at least once a week sound familiar? What if taking a break gave you the clarity to realize what truly makes you happy? And what if that thing isn’t all that expensive?

If you’re planning to travel, you could consider spending time in a city or country that has a lower cost of living than where you currently live. And you can look into lower cost lodging options like Couchsurfing or Workaway. You can even look into house swaps (yes they are real a thing!).

Exploring different options and budget ranges can be helpful in seeing that taking a mini-retirement really could be possible for you.

And you can plan your mini-retirement to match a budget of what you already have saved, both in terms of money and time.

The nice thing about mini-retirements is that they’re mini.

With the timeframe being shorter than a full sabbatical, the amount of time it can take to save for a mini-retirement can also be shorter.

And the possibilities of whether you return to your current job are also a bit simpler. It can be easier to ask for a month off – potentially unpaid – than to ask for a year or more. If you want the comfort of knowing what you can do for income after your mini-retirement, this may be a good option for you.

Being intentional about what you want to get out of the mini-retirement can be one of the most valuable ways to prepare for it.

No matter your budget, timeframe, or plans, here are some things you could learn by taking a mini-retirement:

- How does the transition from working to not working feel? How long does it take to feel bored or unfulfilled?

- How much does your intended lifestyle cost?

- Once you’re out of the day-to-day, what would you like to build back into your life and what would you like to make sure to avoid this time around?

Taking some time to reflect on these questions during your mini-retirement can help you get the most out of the experience, and can help you decide if and when you might want to do it again!

The hardest place to be is indecision – once you decide you want to take a break, the planning can begin!

What’s important is to understand your current situation and your desired outcome. Knowing that, we can help put together the ideal financial plan FOR YOU!

Whether you want to plan one or multiple mini-retirement breaks, or a full sabbatical, we are here to help you think through your options and plan the necessary steps so you can leave feeling like things are being taken care of!

Curious? Contact us now.

Like this article? Make sure to Pin It so you can go back to it later!