When it comes to financial planning, there are various strategies tailored to different life stages and goals. Traditional financial planning focuses on long-term financial security, typically in preparation for retirement. On the other hand, sabbatical planning caters to individuals who seek to take extended breaks from their careers for personal or professional development.

What is important to note is that these two approaches can complement each other.

You don’t have to sacrifice your retirement or other financial goals when saving for your sabbatical year.

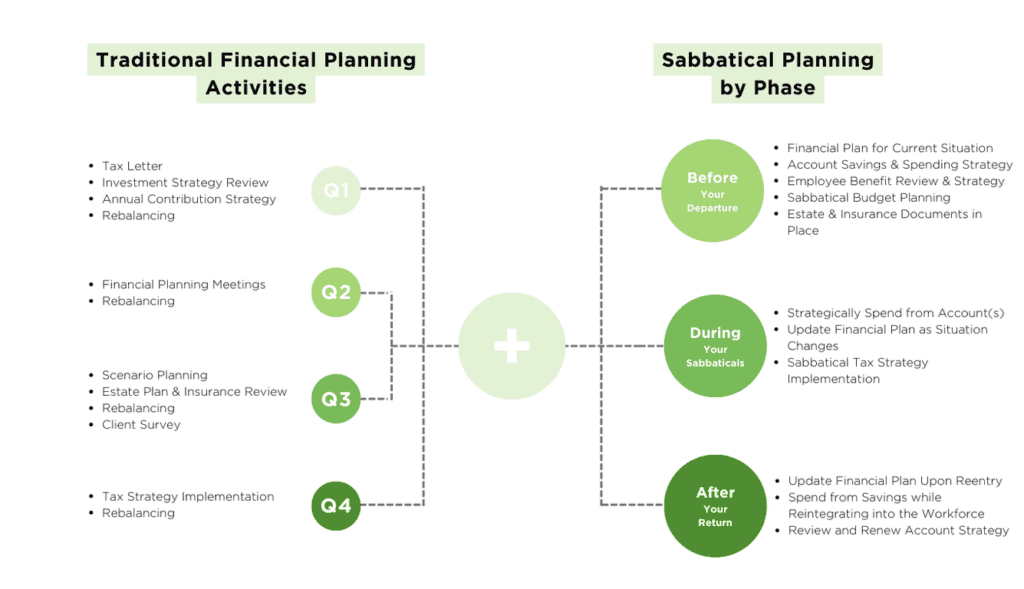

At Middleton & Company, we are financial planners specializing in assisting mid-career professionals planning for a year or more off work. To do that, we integrate traditional financial planning strategies with personalized sabbatical planning.

To better understand the difference between traditional financial planning and sabbatical planning, let’s review each financial area in the table below:

Traditional financial planning vs sabbatical planning

- Traditional financial planning

- sabbatical planning

| Traditional financial planning | sabbatical planning | |

*In addition to the elements of traditional financial planning | ||

| Income | Maximize income potential, plan on steady pay increases over time | Plan for periods of reduced/no income mid-career |

| Savings | Prioritize saving to retirement accounts first (401(k), 403(b), IRA) | Strategically save to various account types to allow for pre-retirement withdrawals without penalty |

| Investments | Determine risk tolerance based on retirement date | Strategically invest accounts based on different time horizons and risk levels |

| Taxes | Mitigate taxes as possible, consider tax strategies between retirement and claiming Social Security | Mitigate taxes as possible, proactively plan for tax strategies in low-income sabbatical year(s) |

| Estate Planning | Ensure will/trust, guardian, beneficiaries, and health directives are in place | Discuss power of attorney |

| Insurance | Assess life, disability, and umbrella insurance needs | Assess health, car, and travel insurance needs | Buy Now |

Financial Planning Timeline

Here is what it looks like throughout the year.

While traditional financial planning focuses on long-term wealth accumulation leading up to retirement (which is important), sabbatical planning accounts for changes in saving and spending to support individuals who wish to take extended breaks from their careers. By understanding the key differences and implementing appropriate strategies, individuals can ensure financial stability throughout their career and their life and make the most of their sabbatical experiences without jeopardizing their future goals.

Dare to follow your own career path and let your financial plan support you!

We are on a mission to make sabbatical breaks not only possible but also an important, intentional, and rich part of your career through smart financial planning.